RESOURCES FROM GORES, LOCAL GOVERNMENTS AND PUBLIC UNIVERSITIES FOR OXI GROW TO MORE THAN S/ 25,000

Lima, July 17, 2023.- The Private Investment Promotion Agency (PROINVERSIÓN) informed that the resources of the regional governments (GOREs), local governments and public universities to execute projects through the mechanism of Works for Taxes total S/ 25,613 million, which represents an increase of 58% with respect to the amount fixed in 2022 (S/ 16,237 million).

This increase was established by Supreme Decree No. 138-2023-EF - endorsed by the Ministry of Economy and Finance - which approves the annual capacity ceilings of regional and local governments, and public universities for the issuance of Regional and Local Public Investment - Public Treasury Certificates (CIPRL).

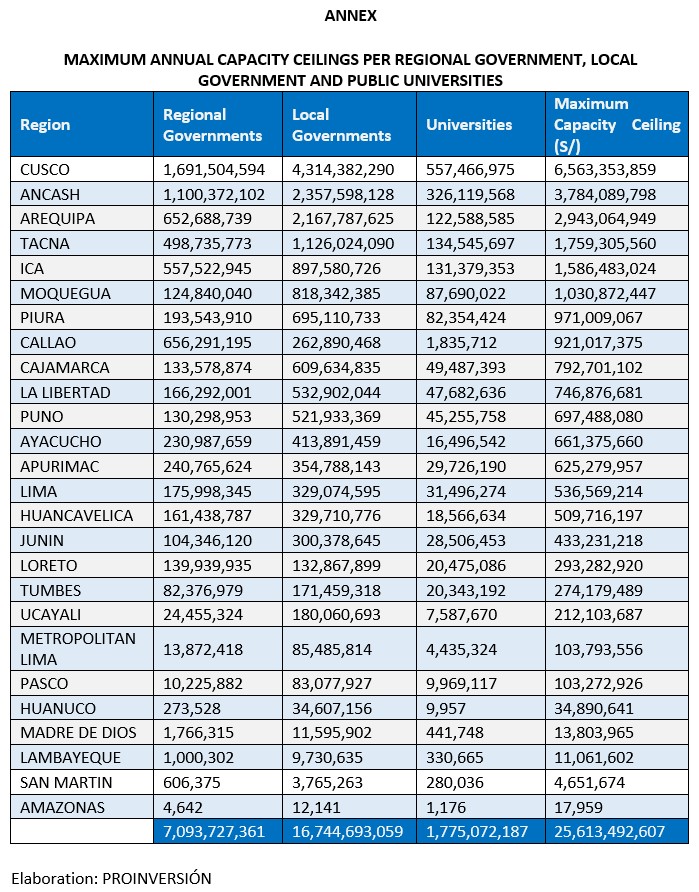

Within this framework, the potential for the application of the Works for Taxes mechanism at the regional government level amounted to S/ 7,094 million, which means an increase of 72% with respect to the ceiling established in 2022 (S/ 4,119 million); the potential of local governments amounted to S/ 16,745 million, which represents an increase of 51% with respect to the amount established in 2022 (S/ 11,101 million); while the resources available to public universities grew to S/ 1,775 million, which represents an increase of 75% compared to the S/ 1,017 million established in 2022.

"The substantial increase in the maximum annual capacity ceilings for the issuance of CIPRL certificates by regional governments, local governments and public universities will allow these entities to develop more high-impact projects and interventions through Works for Taxes, contributing to the closing of infrastructure and public services gaps in a decentralized manner", highlighted PROINVERSIÓN's executive director, José Salardi.

TOP 5 BY DEPARTMENT

At the departmental level, public entities in Cusco (regional government, local governments and public universities) lead with a ceiling of S/ 6,563 million to implement projects through Works for Taxes, which means an increase of 55% over the 2022 ceiling (S/4,230 million. This is followed, in second place, by the public entities of the department of Ancash, with a maximum ceiling of S/. 3,748 million, 42% higher than the figure of S/ 2,667 million in 2022. In third position are the public entities of the department of Arequipa with S/ 2,943 million to execute Works for Taxes, which implies an increase of 47% with respect to what was set in 2022 (S/ 1,996 million). In fourth place are the public entities of Tacna with a ceiling of S/ 1,759 million (an increase of 82% with respect to 2022); and in fifth place are the public entities of Ica with a ceiling of S/ 1,586 million, which implies a growth of 141% with respect to the amount set in 2022. For other departments, see Annex.

WORKS FOR TAXES

Works for Taxes is a mode of execution of public investment, which allows to have quality projects (executed quickly) with participation of private company. The private party finances the Public Investment Project and, after the work is delivered, recovers the investment in certificates for the payment of third category income tax; the independent regulatory framework expedites the execution of public investment and simplifies procedures.

Since the implementation of this mechanism (2009), approximately 21 million Peruvians have benefited from the development of 514 works, for an amount of S/ 7,043 million.

PROINVERSIÓN, as a State entity, provides free advice and technical assistance to national government entities, regional governments, local governments and public universities, articulating them with private companies interested in financing these projects.

Source: Press Release - PROINVERSIÓN