Advantages of investing in Peru

Advantages of investing in Peru

Advantages of investing in Peru

Trade integration policy - market access

A sustained trade opening policy over time

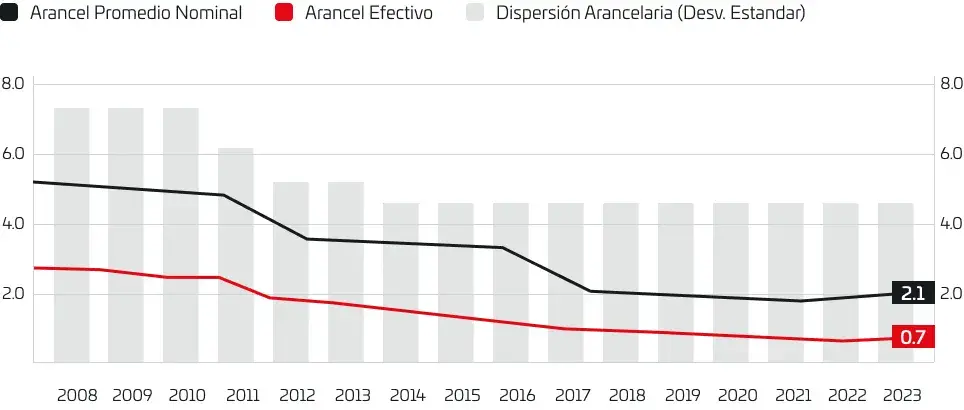

Evolution of the nominal and effective tariff and dispersion 202 – 2023*

(*) As of June 2023.

Source: MEF

Note

1) Effective tariff = (Total Avaloren CIF collection amount / Total CIF import amount) * 100.

2) Tariff dispersion = Standard deviation

Reduced tariff structure with low dispersion

| ADVALOREM LEVEL | SUB HEADINGS* | |

|---|---|---|

| NUMBER | PROPORTION (%) | |

| 0 | 5,727 | 71.60% |

| 6% | 1,602 | 20.00% |

| 11% | 674 | 8.40% |

| TOTAL | 8,003 | 100% |

| AVERAGE NOMINAL TARIFF % | 2.1 | |

| EFFECTIVE TARIFF % ** | 0.7 | |

| CUSTOMS DUTY DISPERSION % | 3.6 | |

* Based on the 2022 Customs Tariff

** Effective Tariff = (CIF Ad Valorem Collection Amount / CIF Import Amount) * 100

Source: SUNAT-MEF

An economy that works in the process of globalization, with preferential access to the largest markets

Access to more than 3 billion consumers in countries that account for 79% of global GDP. 94% of Peruvian exports are covered by these agreements.

Trade integration policies - market access