Advantages of investing in Peru

Advantages of investing in Peru

Advantages of investing in Peru

Macroeconomic Context

Macroeconomic Indicators

Responsible Fiscal Policies: A Model in Latin America

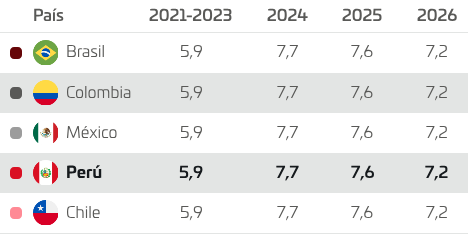

During the period from 2021 to 2023, Peru stood out for its sound fiscal management, with an average deficit of 2.3 percentage points, below that of most countries in the region. This performance puts the country in a favorable position compared to economies such as Brazil, Colombia, and Mexico.

In addition, Bloomberg projections indicate a positive trend toward the end of 2024 (3.5% GDP), but with a downward adjustment in subsequent years. Reaffirming Peru as a benchmark for fiscal responsibility in the region.

Fiscal deficit in Latin America'

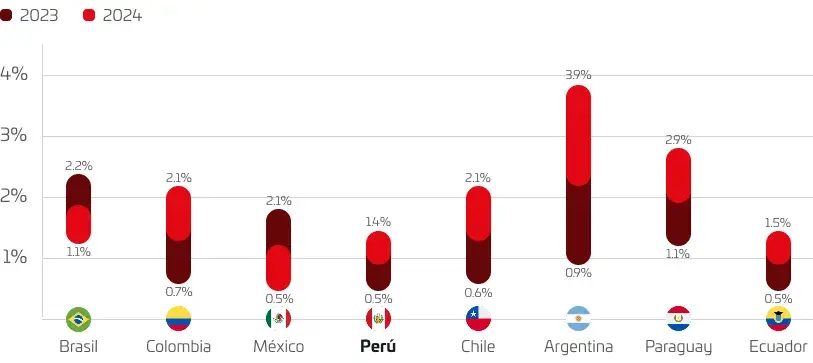

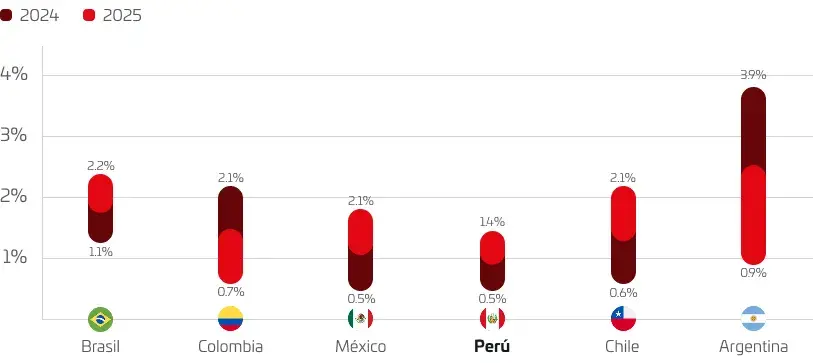

Controlled Inflation: Peru is in an Advantageous Position in Latin America

Inflation in Latin America

Fuente: Bloomberg.

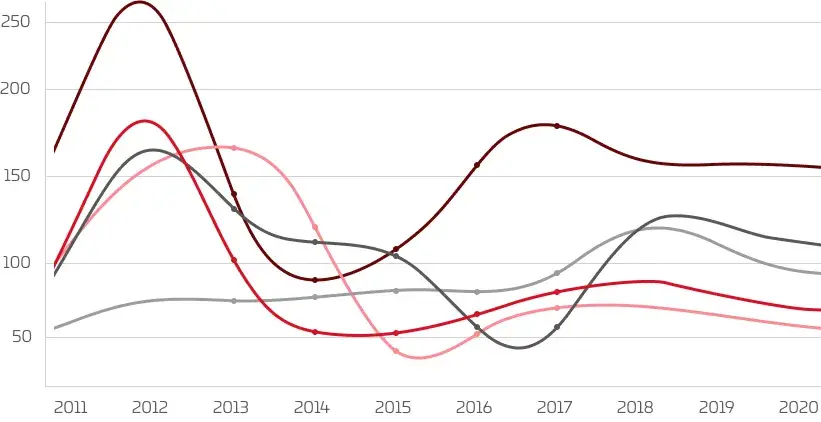

Weakening of currencies in Latin America

Exchange rate in Latin America

Fuente: Bloomberg.

Economic growth

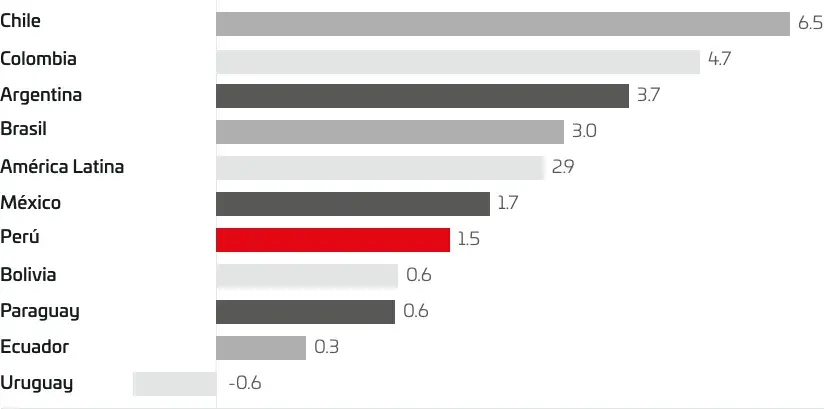

Sustained Growth in Gross Domestic Product (GDP): Peru Leads the Region

Peru’s economy is expected to grow by an estimated 2.6 percentage points in 2025, outpacing key countries such as Colombia, Chile, Mexico, and Brazil.

Latin America: Gross Domestic Product Projection, 2024-20251/

Sustained Gross Domestic Product (GDP) Growth: Stable and Promising Performance

Year | GDP (millions of soles in 2007) | Percentage variation in GDP |

|---|---|---|

Average | 2,3% | |

2014 | 467 308 | 2,4% |

2015 | 482 506 | 3,3% |

2016 | 501 581 | 4,0% |

2017 | 514 215 | 2,5% |

2018 | 534 626 | 4,0% |

2019 | 546 605 | 2,2% |

2020 | 487 191 | -10,9% |

2021 | 552 560 | 13,4% |

2022 | 567 390 | 2,7% |

2023 | 564 261 | -0,6% |

Note

Per Capita GDP Growth: Improving the Well-being of Peruvians

Year | GDP per capita (Soles in 2007) | Percentage variation in GDP per capita |

|---|---|---|

Average | 0,9% | |

2014 | 15 779 | 1,4% |

2015 | 16 103 | 2,1% |

2016 | 16 487 | 2,4% |

2017 | 16 602 | 0,7% |

2018 | 16 939 | 2,0% |

2019 | 17 012 | 0,4% |

2020 | 14 933 | -12,2% |

2021 | 16 726 | 12,0% |

2022 | 16 989 | 1,6% |

2023 | 16 731 | -1,5% |

Investment

Investment Growth: Driving Sustainable Development

Year | Gross Domestic Investment – GDI1/ (millions of Soles in 2007) | Percentage variation in GDI |

|---|---|---|

Average | 1,0% | |

2014 | 127 664 | -2,2% |

2015 | 121 496 | -4,8% |

2016 | 116 614 | -4,0% |

2017 | 116 234 | -0,3% |

2018 | 121 327 | 4,4% |

2019 | 125 337 | 3,3% |

2020 | 104 980 | -16,2% |

2021 | 141 318 | 34,6% |

2022 | 142 311 | 0,7% |

2023 | 134 634 | -5,4% |

1/ The GDI includes private and public Gross Fixed Investment and variations in inventories.

Private Investment Participation: A Pillar of Economic Growth

Year | Gross Domestic Investment – GDI1/ (millions of Soles in 2007) | Private Gross Fixed Investment (millions of Soles in 2007) | Share of private Gross Fixed Investment |

|---|---|---|---|

Average | 80,5% | ||

2014 | 127 664 | 102 542 | 80,3% |

2015 | 121 496 | 98 101 | 80,7% |

2016 | 116 614 | 93 159 | 79,9% |

2017 | 116 234 | 93 199 | 80,2% |

2018 | 121 327 | 97 026 | 80,0% |

2019 | 125 337 | 101 406 | 80,9% |

2020 | 104 980 | 84 654 | 80,6% |

2021 | 115 974 | 141 318 | 82,1% |

2022 | 142 311 | 115 451 | 81,1% |

2023 | 134 634 | 107 032 | 79,5% |

1/ The GDI includes private and public Gross Fixed Investment and variations in inventories.

Private Investment: A Key Driver of Peru’s GDP

Year | GDP (millions of Soles in 2007) | Private Gross Fixed Investment (millions of Soles in 2007) | Share of private Gross Fixed Investment |

|---|---|---|---|

Average | 19,3% | ||

2014 | 467 308 | 102 542 | 21,9% |

2015 | 482 506 | 98 101 | 20,3% |

2016 | 501 581 | 93 159 | 18,6% |

2017 | 514 215 | 93 199 | 18,1% |

2018 | 534 626 | 97 026 | 18,1% |

2019 | 546 605 | 101 406 | 18,6% |

2020 | 487 191 | 84 654 | 17,4% |

2021 | 552 560 | 115 974 | 21,0% |

2022 | 567 390 | 115 451 | 20,3% |

2023 | 564 261 | 107 032 | 19,0% |

1/ The IBI includes private and public Gross Fixed Investment and inventory changes.

Peru: Exceeding the Regional Average in Foreign Direct Investment

Foreign Direct Investment as net capital inflow, 2023

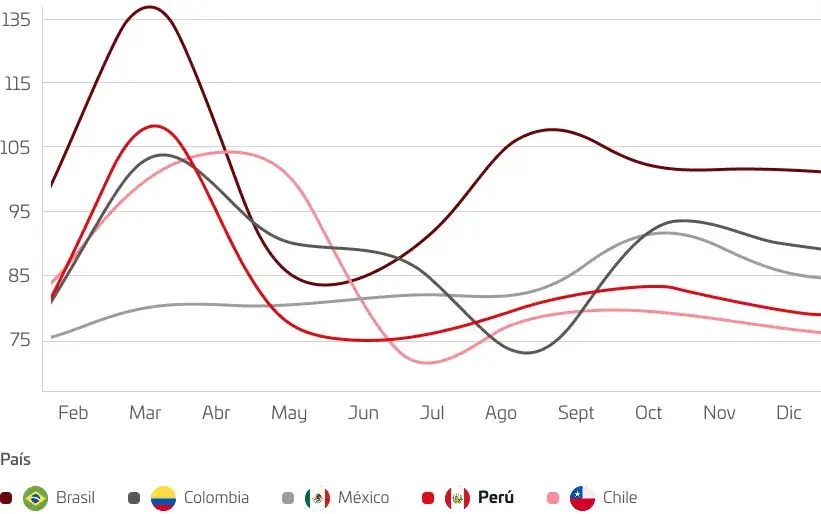

Business confidence

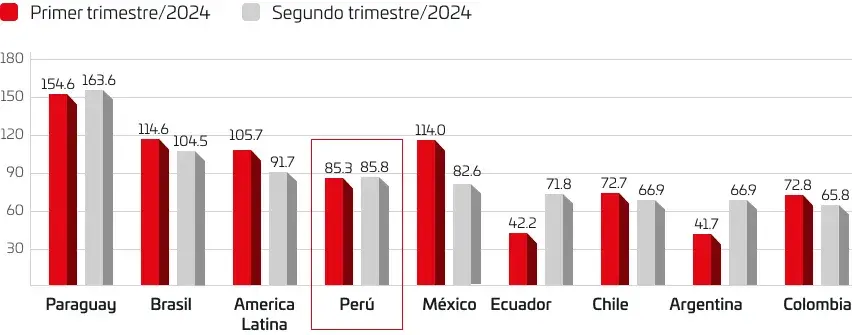

Economic climate indicator in Latin America

Economic Climate Indicator for Latin American Countries (in points)

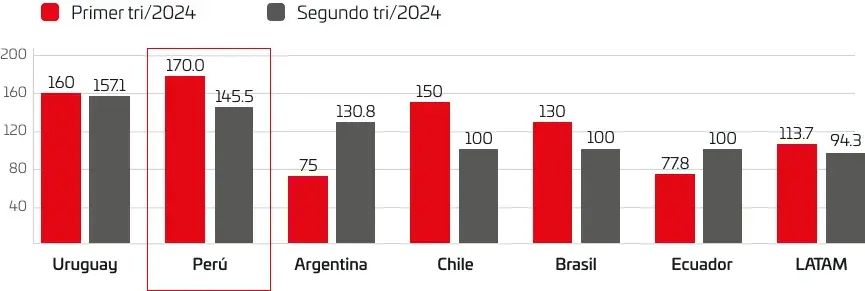

Expectations Indicator for the next six months in Latin America

Expectations Indicator for selected countries (in points)

Business Confidence Indicator

Date | 3-month economic expectations index |

|---|---|

May-23 | 44,5 |

Jun-23 | 42,8 |

Jul-23 | 44,5 |

Aug-23 | 44,1 |

Sep-23 | 40,4 |

Oct-23 | 38,7 |

Nov-23 | 37,6 |

Dec-23 | 41,2 |

Jan-24 | 43,8 |

Feb-24 | 47,2 |

Mar-24 | 50,8 |

Apr-24 | 50,0 |

May-24 | 47,5 |

Jun-24 | 50,4 |

Jul-24 | 51,1 |

Aug-24 | 51,9 |

Sep-24 | 51,8 |

Oct-24 | 51,7 |

Nov-24 | 50,6 |

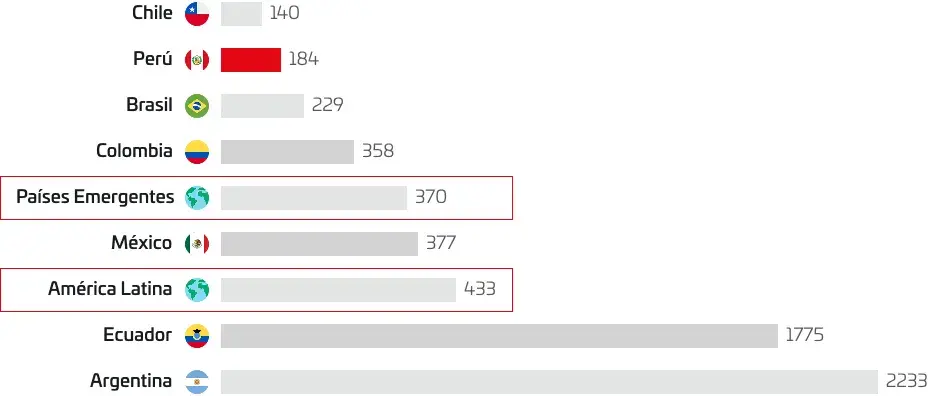

Country risk

Average country risk measure through 2023

Country Risk Rating

Country risk rating for 20241/

Country/region | Moody’s | S&P | Fitch |

|---|---|---|---|

Chile | A2 | A | A- |

Brasil | Ba1 | BB | BB |

Uruguay | Baa1 | BBB+ | BBB |

Perú | Baa1 | BBB- | BBB |

México | Baa2 | BBB | BBB- |

Colombia | Baa2 | BB+ | BBB- |

Panamá | Ваа3 | BBB | BB+ |

Paraguay | Baa3 | BB+ | BB+ |

El Salvador | Caa1 | B- | CCC+ |

Ecuador | Caa3 | B- | CCC+ |

Bolivia | Caa3 | CCC+ | CCC |

Argentina | CA | CCC | CCCu |

Note

Network of trade agreements:

Promoting Access to International Markets

In the area of investment, Peru has signed a series of key agreements, including bilateral agreements for the promotion and reciprocal protection of investments (APPRI), as well as broader trade agreements that include investment-related commitments.

With a solid network of 22 trade agreements in force, Peru not only facilitates access to international markets but also contributes to reducing trade barriers, thereby boosting investment flows and foreign trade.

22 trade agreements in force and investment commitments (chapters)

# | Agreement | Partner | Effective Date | Investment Chapter |

|---|---|---|---|---|

1 | Andean Community (CAN) | Bolivia, Colombia,

Ecuador | Cartagena Agreement

May 26, 1969

| Decisions of the CAN 292 and 293 |

2 | Economic Complementation Agreement – ACE 50 | Cuba | March 9, 2001 | X |

3 | Economic Complementation Agreement – ACE 58: MERCOSUR | Argentina

Brasil

Paraguay

Uruguay | January 2, 2006, with Argentina, Brazil, and Uruguay

February 6, 2006, with Paraguay

| X |

4 | Free Trade Agreement between Peru and Chile – Expanded ACE 38 | Chile | March 1, 2009 | X |

5 | The United States – Peru Trade Promotion Agreement (TPA) | Estados Unidos | February 1, 2009 | X |

6 | Canada-Peru Free Trade Agreement (FTA) | Canadá | August 1, 2009 | X |

7 | Peru-Singapore Free Trade Agreement (FTA) | Singapore | August 1, 2009 | X |

8 | China-Peru Free Trade Agreement | China | March 1, 2010 | X |

9 | South Korea-Peru Free Trade Agreement (FTA) | South Korea | August 1, 2011 | X |

10 | Protocol between the Republic of Peru and The Kingdom of Thailand to accelerate the liberalization of trade in goods and trade facilitation, and its additional protocols | Thailand | December 31, 2011. | APPRI of 11.15.1993 |

Source: Ministry of Foreign Trade and Tourism (MINCETUR)

- WTO: It is made up of 166 economies, among which Peru has been a contracting party to GATT of 1947 since October 7, 1951 and a founding member of the WTO since January 1, 1995 .

- APEC: 21 economies. Among them, Peru has been a member since November 1998 (Australia, Brunei Darussalam, Canada, Chile, China, Hong Kong, Indonesia, Japan, Korea, Malaysia, Mexico, New Zealand, Papua New Guinea, Peru, Philippines, Russia, Singapore, Chinese Taipei, Thailand, United States, and Vietnam).

APEC: Connecting Peru with the Major Pacific Economies

Agreements for the Promotion and Reciprocal Protection of Investments (APPRI)

# | País | Date | Enlace del Acuerdo |

|---|---|---|---|

1 | Germany | 01.05.1997 | Go to link |

2 | Argentina | 24.10.1996 | Go to link |

3 | Australia | 02.02.1997 | Go to link |

4 | Republic of Korea | 03.06.1993 | Go to link |

5 | Canada | 14.11.2006 | Go to link |

6 | Chile | 02.02.2000 | Go to link |

7 | Colombia | Convenio: 30.12.2010

APPRI: 26.04.1996 | Go to link |

8 | Costa Rica | 01.06.2013 | Go to link |

9 | Cuba | 25.11.2001 | Go to link |

10 | Denmark | 17.02.1995 | Go to link |

11 | El Salvador | 15.12.1996 | Go to link |

12 | Spain | 17.02.1996 | Go to link |

13 | United States | 01.02.2009 | Go to link |

14 | Finland | 14.06.1996 | Go to link |

15 | France | 30.05.1996 | Go to link |

16 | Iceland 2 | 01.10.2011 | Go to link |

17 | Italy | 18.10.1995 | Go to link |

18 | Japan | 10.12.2009 | Go to link |

19 | Honduras | 01.01.2017 | Go to link |

20 | Liechtenstein 2 | 01.07.2011 | Go to link |

21 | Malaysia | 25.12.1995 | Go to link |

22 | México | 01.02.2012 | Go to link |

23 | Norway 2 | Convenio 01.07.2012 APPRI 05.05.1995 | Go to link |

24 | Netherlands | 01.02.1996 | Go to link |

25 | Panamá | 01.05.2012 | Go to link |

26 | Paraguay | 18.12.1994 | Go to link |

27 | Portugal | 18.10.1995 | Go to link |

28 | United Kingdom | 21.04.1994 | Go to link |

29 | Czech Republic | 06.03.1995 | Go to link |

30 | People’s Republic of China | Convenio 01.03.2010 APPRI 09.06.1994 | Go to link |

31 | Romania | 01.01.1995 | Go to link |

32 | Singapore | Convenio 01.08.2009 APPRI 27.02.2003 | Go to link |

33 | Sweden | 01.08.1994 | Go to link |

34 | Switzerland 2 | Convenio 01.07.2011 APPRI 23.11.1993 | Go to link |

35 | Thailand | 15.11.1993 | Go to link |

36 | Belgium-Luxembourg Economic Union | 11.09.2008 | Go to link |

37 | Venezuela | 18.09.1997 | Go to link |

38 | Agreement with the European Union 3 | 01.03.2013 | Go to link |

Source: PROINVERSION